Unlock the editor’s digestion for free

Rula Calaf, FT editor, chooses his favorite stories in this weekly newsletter.

The UK economy unexpectedly agreed with 0.1 % in January, highlighting the challenge facing Chancellor Rachel Reeves as he prepares to deliver a spring statement this month.

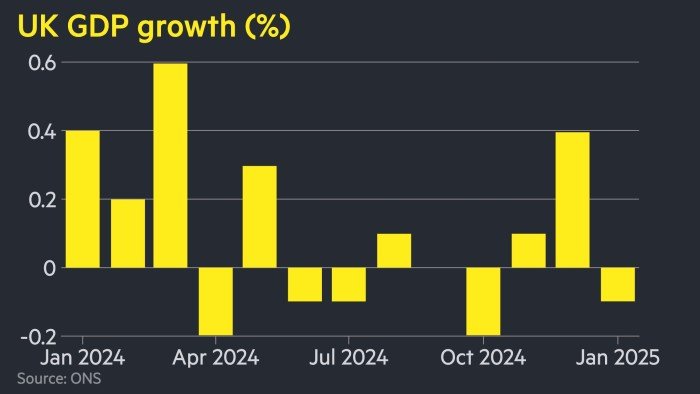

Monthly on Friday GDP The painting of the National Statistics Cabinet was under the growth of 0.1 % projected by economists surveyed by Reuters and 0.4 % in December. The decline was largely driven by weakness in the production sector.

Reeves prepares to Strengthen in public consumption In her spring statement on March 26, after disappointing growth and higher government borrowing costs, it was feared that it was well on its way to breaking down its fiscal rules.

Growth has greatly stopped in May, hitting tax revenue, after Economics in the UK He returned from a technical recession at the beginning of 2024.

Labor lawmakers and some cabinet ministers have expressed concern that Reeves is planning political damage reductions to ease pressure on public finances, including reducing the well -being budget.

“That’s the hardest thing we had to do,” one chancellor’s ally admitted. However, Reeves rejected the prescribing of her fiscal rules to enable greater borrowing, forcing her to do what she called “difficult choices”.

Mel Strid, shades of chancellor, urged Reeves to turn the statement on March 26 into an “emergency budget”, including returning business taxes and leaving what he called “extreme employment legislation”.

The October Budget Responsibility Office envisions economic growth by 2025 to 2 % – twice as much as 1 % projected by Economists surveyed by Reuters. The accumulator is expected to announce a new forecast along with the spring statement.

Suren Tiru, director of the Economy of the Institute for Certified Accountants, said the GDP contraction in January made Reeves’ spring statement “more problematic”, as it increased the likelihood that the turn would degrade its forecasts, “further undermining spending plans”.

The pound weakened slightly after the data was released on Friday, a 0.2 percent decrease compared to the dollar to $ 1,292. Gilts made minor gains in the morning trading, forcing the 10-year-old yield to 0.02 percentage points to 4.67 %.

The figures come as a result of Donald Trump’s escalative trade war, he added to the UK’s economic strains, as well as the prospect of higher defense spending, as the US president disrupts Western security alliances.

“The world has changed and we feel the consequences around the world,” Reeves said in response to Friday’s figures.

As a result, she said: “We are launching the largest sustainable increase in the cost of defense from the Cold War, fundamentally reshaping the British state to deliver to working people and their families and take the blockers to get the UK again.”

The Labor Party won the general election last July with the promise to begin growth, but Reeves has faced criticism of its October budget, which has left business entities to carry the 40 billion -pound burden in raising taxes.

Businesses have warned of reducing jobs as a result of the measures that take effect in April.

Paul Daes, an economist in consulting capital economics, said the decline in production in January “highlights the weakness of the economy before the full effects of business tax rise and uncertain global background was felt.”

The Bank of England is expected to hold the 4.5 % waiting rates at next week, amid signs of return to inflation. Last month, the Central Bank reduced its forecast for economic growth for the first quarter of 2025 to 0.1 %, from 0.4 % expected in November.

Despite the contraction of January, Tiru said the reduction of the rate by BoE next week is “unlikely” because the set rate is likely to want to assess the impact of the increase in national contributions to insurance for budget employers.

Friday’s data have healed traders’ expectations that there will be at least two reductions in Boe’s quarter-point interest rates this year, with a little chance of a third, according to Swaps markets.

According to UNs on Friday, the production sector contract with 1.1 %in January, with a drop in construction by 0.2 %, while services increased by 0.1 %.

Liz McCain, Director of ONS Economic Statistics, said the overall picture of the UK economy is “poor growth”.

However, services continued to grow in January, she said, “led by a strong month of retail, especially food shops, as people ate and drank more at home.”

The UNS said the publication of trading data, usually published along with GDP figures, has been delayed due to errors.

Source link