(Bloomberg) – The intensified global trade war increases the risks of sharp slowdown in US growth and investor portfolios.

Most read by Bloomberg

Both actions and bonds are on the wild driving in the first three months of the year in response to President Donald Trump’s tariffs. But one thing becomes clear in this background: bonds are a better bet on stocks even when the dollar is waving a safe shelter.

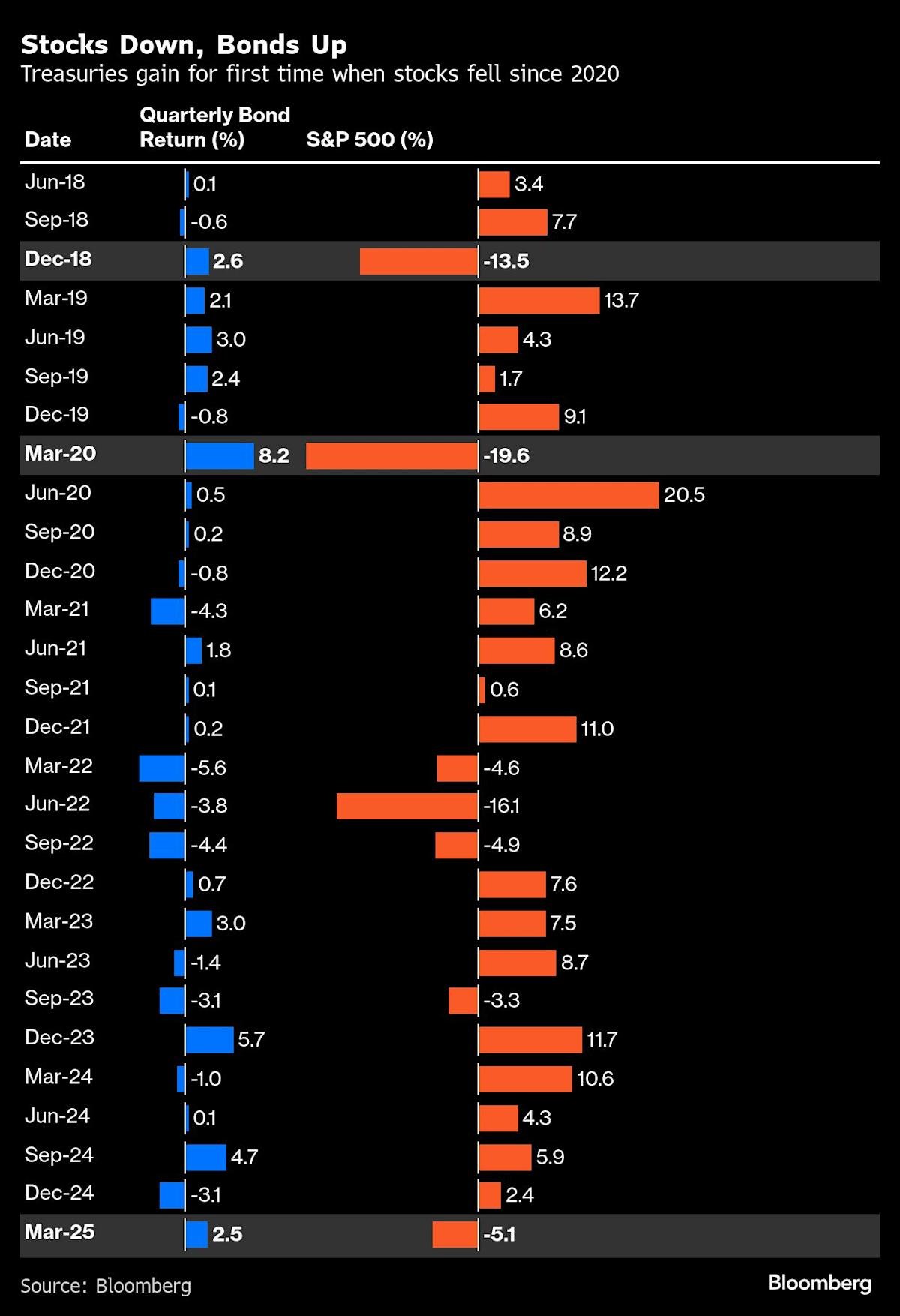

The US Finance Department exceeded the shares of this quarter, heading to more than 2% profit, while the S&P 500 capital benchmark fell by about 5%. It indicates the first time since the beginning of the pandemic in March 2020 that stocks fell and bonds increased in a quarterly period.

Barclays, led by Ayay Rajadiaksha, have shifted their view of the allocation of funds last week in favor of the bonds over global capital for the first time in “several” quarters, saying uncertainties in politics are “lack” risks for economic growth.

More than $ 5 trillion has evaporated from the US stock market since the end of February, as Trump plans to impose reciprocal taxes on trading partners on April 2 as part of his tariff pressure. Its administration also has sectors such as cars and industrial metals aimed at boosting US production and employment.

“If the capital market is repaired lower, it tightens financial terms,” said Jackec McBintir, a portfolio manager in Global Investment Management in Brandivin. “And that’s good for the bonds. You will be better off buyer of weakness.”

In addition to tariffs, investors will draw attention to Friday’s job report to get the latest reading market reading. Economists expect a slowdown in wage growth and a stable unemployment rate.

“We believe that the risks of yields are reduced in the downside if employment data is disappointed,” wrote Subadra Rajapa, head of the US Societe General Price Strategy on Friday.

“Real Return”

The temporary return of traditional correlation between stocks and bonds is a welcome relief for investors. After all, it is the cornerstone of the 60/40 portfolio, a strategy that was largely out of fever since 2022, when at the same time, at the same time, it was further astonishing actions and bonds.

Since bonds offer investors a “real return”, with yields currently higher than inflation, “it is ideal to increase the distribution in the entire portfolio,” said Earl Davis, head of a fixed income of BMO Global Asset Management, on Bloomberg television.

Source link