Martin Marietta Materials, Inc. (Nyse:MLM) On Thursday announced that Second quarter 2025 Revenue of $ 1.811 billion, an increase of 3% over a year, but below the analyst’s $ 1.896 billion.

Net earnings rose 12% to $ 328 million, while diluted earnings per share reached $ 5.43, Beating an estimate of $ 5.35.

The adjusted EBITDA rose 8% to $ 630 million, and the margin expanded by 168kg to 34.8%. The gross received the gross grew by 5% to $ 544 million.

Read and: Overview of Martin Marietta Materials Earnings

The building materials business delivered $ 1,721 billion in revenue, which is 2%, with gross profit increased by 3% to $ 517 million. Aggregates revenue increased by $ 6% to $ 1.32 billion, supported by a 7% increase in the average sales price to $ 23.21 per ton, despite a collection of 1%.

The gross receipt of the units rose 9% to $ 430 million, with the margin expanding to 33%.

Cement and prepared mixed concrete fell 6% to $ 245 million, with gross profit reduced by $ 25% to $ 54 million. Asphalt and paving revenues dropped by 7% to $ 228 million, and gross obtained fell 8% to $ 33 million.

Magnesia’s specialties have released a record $ 90m revenue. The gross obtainable jumped 32% to $ 36 million, with the margin improving to 40%, driven by high prices, improved VAR shipments and operational efficiency.

Operational activities for the first half of 2025 amounted to $ 605 million, up to $ 173 million the previous year. Capital expenditures reached $ 412 million.

The company returned $ 547 million to shareholders through dividends and ransom. It ended the quarter with $ 225 million in cash and $ 1.2 billion in loan.

Martin Marietta completed Premier Magnesia’s acquisition on July 25. He also signed a contract with Quiret on August 3 to exchange his cement factory Middlothian and related assets for aggregate operations that produce 20 million tonnes annually, plus $ 450 million in cash. The transaction is expected to close in the first quarter of 2026.

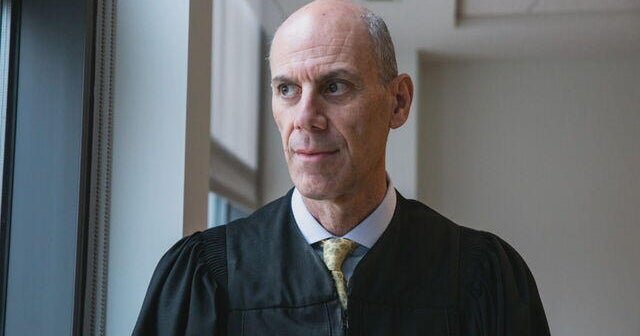

“Demand in our primary end markets remains different. Infrastructure activity remains stable, backed up by a sustainable record level of federal and state investment. In non -resilient, accelerating the development of the data center and warehouse recovery, contributing positively. Ward is aChair and CEO of Martin Marietta.

“The first six months of 2025 represented the lowest total incident rate that can be reported in the history of Martin Marietta. Given our strong performance in the first half, along with the contributions of acquisition and current consignment trends, we increase the entire annual adjusted EBITDA. said NYE.

Source link