Unlock the White House viewing newsletter for free

Your Guide to what Trump’s second term for Washington, Business and the world means

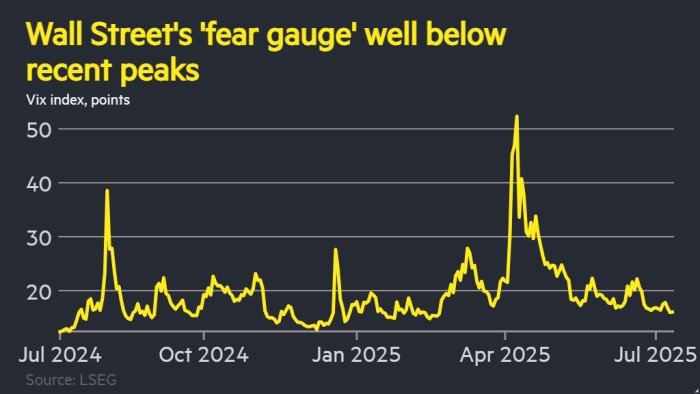

Market volatility has dropped to the lowest levels of the year and stocks trading record highs, as Donald Trump’s anxiety over tariffs melts despite the latest escalation of his trade war.

The VIX Index, a short -term expected unstable measure in the S&P 500, fell to 16, well below its long -term average of about 20. Similar expected index for expected instability In the US US bond market, it is close to the lowest levels in three years.

At the same time, Nvidia led a rush of technological actions as the chipmaker reached an unprecedented 4TN estimate on Wednesday.

The moves come even when the US president has appointed a barrage of fresh trade threats this week, including a 50 % tariff tariff, 200 % of the pharmaceutical sector and countries’ taxes, including Japan, South Korea and the Philippines.

“I don’t care about tariffs,” said Max Katner, head of the strategy for more funds at HSBC. “This is all imposed. What should we prevent them from saying, let’s give him three more months?”

Trump’s latest moves on tariffs are approaching their levels than some analysts expected on steep duties that they revealed in early April to dozens of trading partners.

However, those initial so -called. “Reciprocal” tariffs were later delayed and diverted to the province of actions, and Trump then returned the deadline for duties from July 9 to August.

As a result, investors now understand the current threats of the US president much less seriously than they understood his early rhetoric and bet that the president will eventually withdraw from tariffs that seriously damage us to US growth.

Trade has become known in markets such as “Taco”, an acronym for “Trump always chickens”.

“May 12, it was the big gearbox,” Katner said, referring to the date the United States signed a deal with China, which sharply reduced its previously planned tariffs, making investors returning to risky funds.

“We have learned that Trump has placed,” he added.

In the currency market, Brazil’s 50 % 50 % tariffs knocked out Real on Wednesday, but the wider markets are calm.

CME Group indexes for expected changes in the exchange rate, such as Euro Dollar, are significantly reduced by their elevations in April and are approximately at the level of trading at the beginning of the year.

“There is an opinion that the Trump administration is unlikely to want a repetition of the disruption caused by the tariffs of the” Liberation Day “in early April,” said Lee Hardman, an older currency analyst in Mufg.

Matthias Sheiber, head of multi-funds by US US fund manager, global investment, said: “I can see that it is being tested, but expected to remain trade with Taco, with any volatility to present the opportunity to buy.”

But investors have warned that the huge sense of capital markets in itself can encourage Trump to increase his aggression of trade more than the market expects at the moment.

“With US capital at a record high and the budget, there is a risk that Trump could be encouraged to go harder with tariffs than expected,” Hardman said.

Some investors are more upset that the market is priced at some degree of complacency, with S&P close to record highs and trading in the ratio of earnings ahead of 24. Stock indexes in the UK and Germany trading at all time.

“My concern is that there is now no major margin of security in values,” said Casper Elmgrin, chief investment officer for capital and fixed income in Nordea Asset Management.

“We have the biggest increase in tariffs in one’s living memory, but (the market) has a very relaxed view of what he can do,” Elmgrin said. “I’m worried about lack of concern.”

Source link