Unlock the White House viewing newsletter for free

Your guide to what the US election means in 2024 for Washington and the world

Treasury fell on Friday in unstable trading, as market participants warned of growing types of US $ 29 market for US debt to the US.

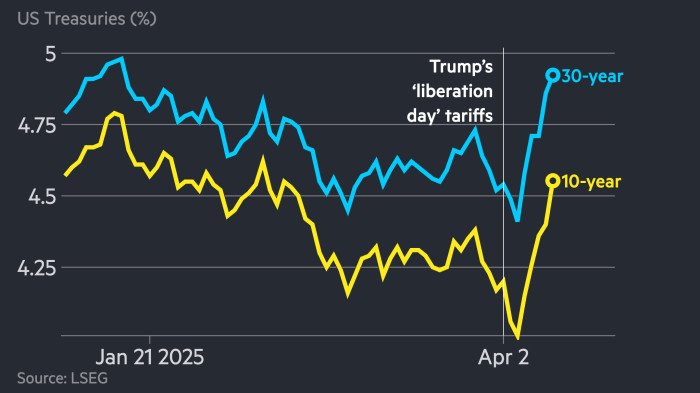

10-year-old Ministry of Finance The yield rose as much as 0.19 percentage points to 4.58 % on Friday, amid deepening of the asset that is traditionally considered a premiere shelter of the global financial system.

The yield later changed some of these winnings to trade by 4.48 % after Boston’s Fed President Susan Collins statements about Financial times, the US Central Bank will “” absolutely be prepared “to deploy its fiery power to stabilize financial markets, need conditions to become messy.

The unstable President of President Donald Trump Tariff policies It rocked investors’ faith in policy making in the United States and the economy, causing exodus from US funds. The ten -year yield increased by almost 0.5 percentage points this week, the biggest increase since 2001, according to Bloomberg.

While Trump withdrew from the so-called reciprocal tariffs for countries that did not return earlier this week-they agree with a 90-day interruption for most major US trading partners-he posted stricter taxes on Chinese imports.

“There is real pressure around the world to sell finances and corporate bonds if you own abroad,” said Peter Tchir, head of the American macro strategy in Academic Securities. “There is a real global concern that they don’t know where Trump goes.”

“We are worried because the movements you see point to something other than normal sale,” said European Bank CEO in Prime Minister Services, a division that facilitates trafficking for companies, including commercial assets and hedge funds. “They point to a complete loss of faith in the strongest bond market in the world.”

Traders said poor liquidity – the ease with which investors can buy and sell funds without moving prices – worsens market moves.

Analysts at JPMorgan said the depth of the market, a measure of market possibility to absorb large crafts without significant price changes, deteriorated significantly this week, which means that even small crafts are significantly moving yields.

While traveling to his Mar-a resort on Friday, Trump said: “The bond market is going well. There was little moment, but I solved that problem very quickly.”

Asked at what extent the bond market engaged in his 90-day reciprocal tariff break in non-departing countries, the president said he did not, despite saying it earlier in the week. “I want to put the country in an incredible economic position. What is where we should be,” he said.

The head of the US bond manager in the US said liquidity is “not great today” and explained that “the depth of the market lasted 80 % below normal average” on Friday.

“If today it blows stiff breeze through the Ministry of Finance market, the rates will move a quarter point,” added Guy Lebas, the chief strategist with a fixed income in Anneny Montgomery Scott.

The Ministry of Finance’s volatility on Friday was accompanied by a dollar decline.

The currency force meter against larger peers fell 1.8 percent on Friday. Sterling, the Japanese yen and the Swiss franc have all achieved significant benefits.

Trump told the dollar: “We are the currency of choice. We will always be. I think the dollar is huge.”

Source link