It is probably not a big surprise that the liberal-left mainstream inheritance is doing everything they can to paint a negative image of President Donald Trump Economic policies.

Now, we have become accustomed to the political media that have been going after Trump for years, with false accusations and wrong conclusions.

But now the false news has spread to economic and business media. And that’s really a pity.

Renowned economists and economic journalists are rising to Trump, using tariffs like a stick to beat him over their heads.

That’s how Narrative “Russia, Russia, Russia” It has now come to an economic cover. And, remember, “Russia Russia” has actually proved to be a big fraud.

Well, now it’s “recession, recession, recession” – another fraud.

Tariffs will cause a recession. Tariffs will cause inflation. The tariffs descend on the stock market.

“Russia, Russia, Russia” – this is what I read.

People need a filter to pass all this madness.

First, there is no recession.

In fact, Breon Carney on Breitbart points out that the labor market is actually stronger than the economists thought and Factory jobs are returning. The January report shows 30,000 new job openings and 30,000 new production employment. The rate of cancellation has grown. S&P Global Production PMI has reached its best level since June 2022. The February employment report was solid.

Some usually reputable economists predicted bulging CPI report in February Because of the tariffs. But the tariffs have not yet started. The report itself was easier than expected, with the lowest number in a few months.

And corporate profit, breast milk and the energy source of the economy are still growing.

Bond yields and mortgage rates actually fall. So are oil prices.

Former Secretary of the Finance Ministry Steven Munucin said “people are overly responding to Trump’s policies” and he sees no signs of immediate slowdown in the US economy.

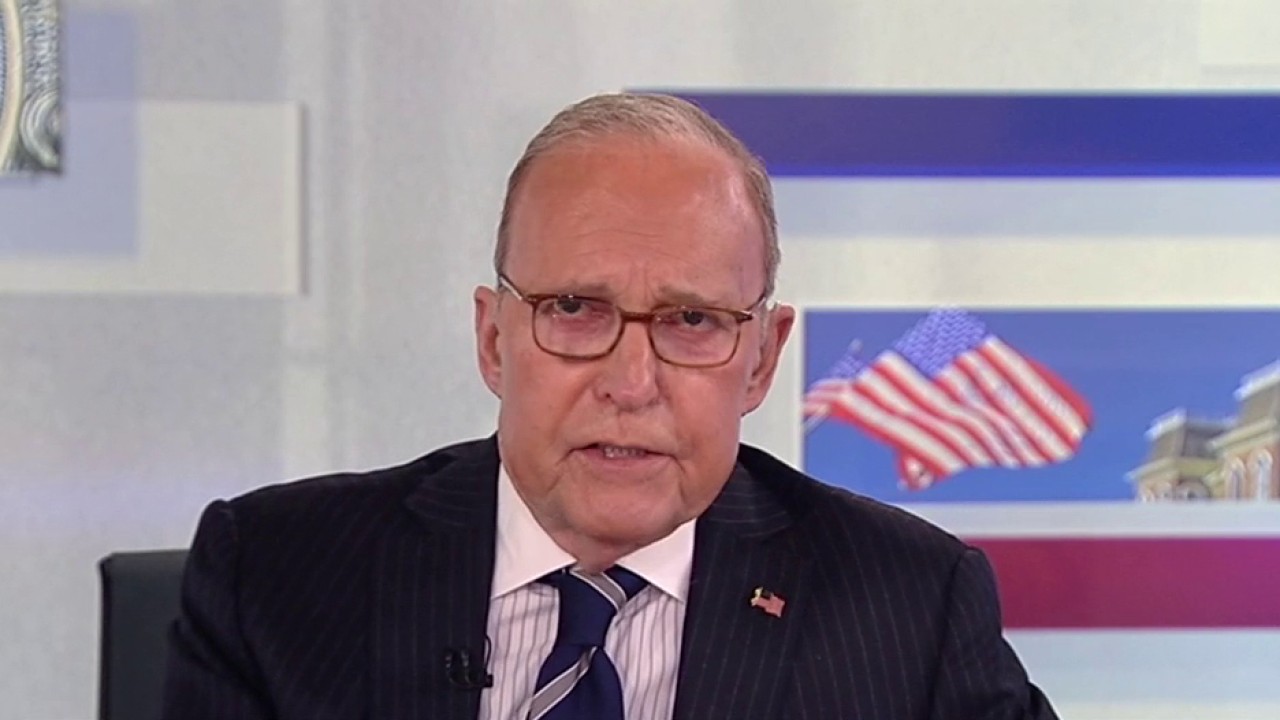

Let me quote my old friend. “I think we won’t have a recession. I think the prospects look like we have a recession, ” He told another network.

I think he’s absolutely right.

Short -term stock corrections come and go. But Trump’s policies are deeply pro-rate.

It aims to revise the economy – by reducing taxes, deregulation, energy production and A. Reciprocal trade policy.

When these policies are fully established, there is a strong growth potential of 3% or better, along with reduced inflation.

And, about the tariffs, let’s step down and see how this story comes out in the next six to twelve months.

It could be good that Mr Trump, the big negotiator, would wind with much more tariff reduction than it increased.

And, however, its business and personal tax cuts are, frankly, far more important for our economic future.

Source link