Globaldata’s research found that over half of the e-scooter owners had not purchased/renewed the product insurance policy. In recent years, the use of e-bike/scooter has grown rapidly, however, the laws on licensing, security standards and accident reporting have not kept the step; Enabling insurance companies to provide comprehensive, well -informed coverage, leaving consumers to be cautious to purchase/renew the insurance policy.

UK consumer consumer survey in the UK in 2024 revealed that 54.8% of consumers who own e-scooter did not purchase/renew the insurance policy in the last 12 months. This may be due to the fact that a policy cannot be found that includes everything they wanted covered, highlighting gaps (under the influence of data deficiency) in insurance policies that do not cover all consumer desires, so, after all, they choose not to buy/renew the insurance policy and face more damage.

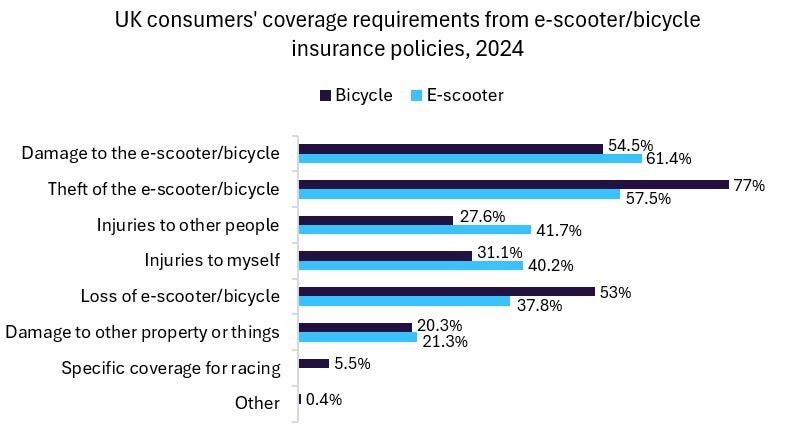

The same research conducted by Globaldata also asked consumers what they would like to cover in their e-scooter policy, which further shows how consumers would like to feel more confident in certain situations, such as injuring themselves and other people, as well as damage to their e-scooter and other property/works.

In addition, road safety flaws will lead to insurance claims, as about 90% of approximately 4,000 major cyclist collisions include a motor vehicle annually and often led to drivers’ claims, even when cyclists may have been negligent or careless as a “unacceptable” And exposed to this risk, it has become an intensified area of detected losses in insurance policies.

The report also mentioned improvements in incident data collection within the road safety data data, as e-bikes/scooters are currently no different from standard bicycles in reporting accidents, nor is the use of helmets. Collecting this data will allow insurance companies to effectively adapt their policies; Providing consumers to feel safer and more reliable. To conclude, using an e-bike on the rise, insurance companies will continue to face the data gap that limits the effective assessment of the risk and development of policy. To close the gap, they must invest in data collection partnerships and start collecting better insights to build more comprehensive coverage solutions for this growing market.

“E-bike/scooter highlights gaps in regulation and insurance” was originally created and published by International Life Insurancebrand owned by Globaldata.

Source link