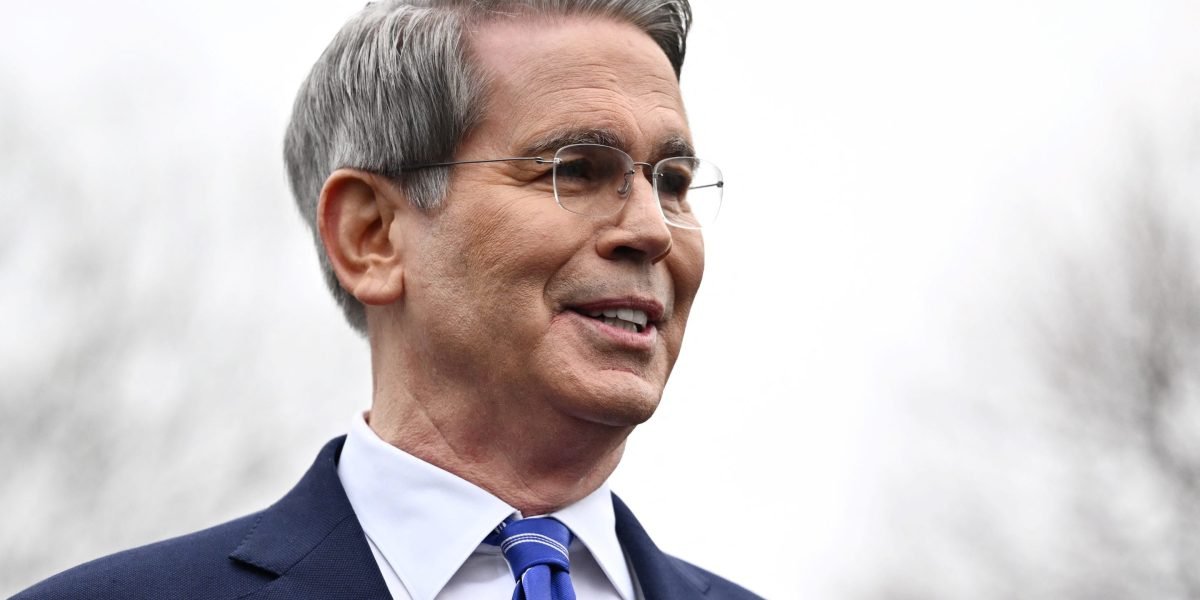

Finance Secretary Scott, Former Hedge Fund Manager, said he was not concerned about the recent fall that deleted trillion dollars from the capital market, as the United States is trying to reshape its economic policies.

“I’ve been to the investment business for 35 years and I can tell you that the corrections are healthy, they are normal,” Rensez said on NBC on Sunday at NBCMeet the press. “I’m not worried about markets. In the long run, if we establish good tax policy, deregulation and energy security, markets will do great. “

TheSaleThis took the S&P 500 index in correction last week amid investor concerns about the economic effects of Trump’s administration’s moves over tariffs, immigration and federal government reduction. Losses in capital markets have deepened concerns about mounting growth and consumer.feeling.

“We establish the policies that will make the crisis with availability, inflation moderate, and as we set the sails, I am convinced that the American people will come on the road,” said Ruben, who led the Kid Square group before joining the administration.

As President Donald Trump’s volume of tariff policy is expanding, consumers through the political spectrum are increasingly worrying that additional duties will lead to higher costs. Global tariffs are now in force of steel and aluminum and has the deadline on April 2 in anticipation of even wider taxes.

Read more:Here’s a range of Trump’s tariff threats and actions

While inflation is cooled last month, every sustainable pickup in pricing prices risks causing households to limit discretion.

In the interview, Begen said that the American dream does not depend on buying cheap goods from China. Instead, families want to afford a home and see their children better than they are.

“These are mortgages, these are cars, it’s a real salary gain,” he said.

As issues are being built on the US economy, Federal Reserve officials are due to meet this week. Fed Chair Jererom PowellemphasizedEarlier this month that the Central Bank should not rush to cut rates, but it is likely to be pressure for uncertainty and risks.

This story was originally shown on Fortune.com

Source link